Infrastructure for fintech builders

From onboarding and payments to compliance and UI — launch and scale your fintech product in weeks, not years.

Our edge

Only what you need — built to move fast.

We know what fintechs need: speed, flexibility, and compliance that won’t slow you down. Our modular stack lets you build quickly and scale confidently — with the same infrastructure that powers licensed financial institutions.

Who it’s for

Perfect for:

Fintech startups

Starting Point

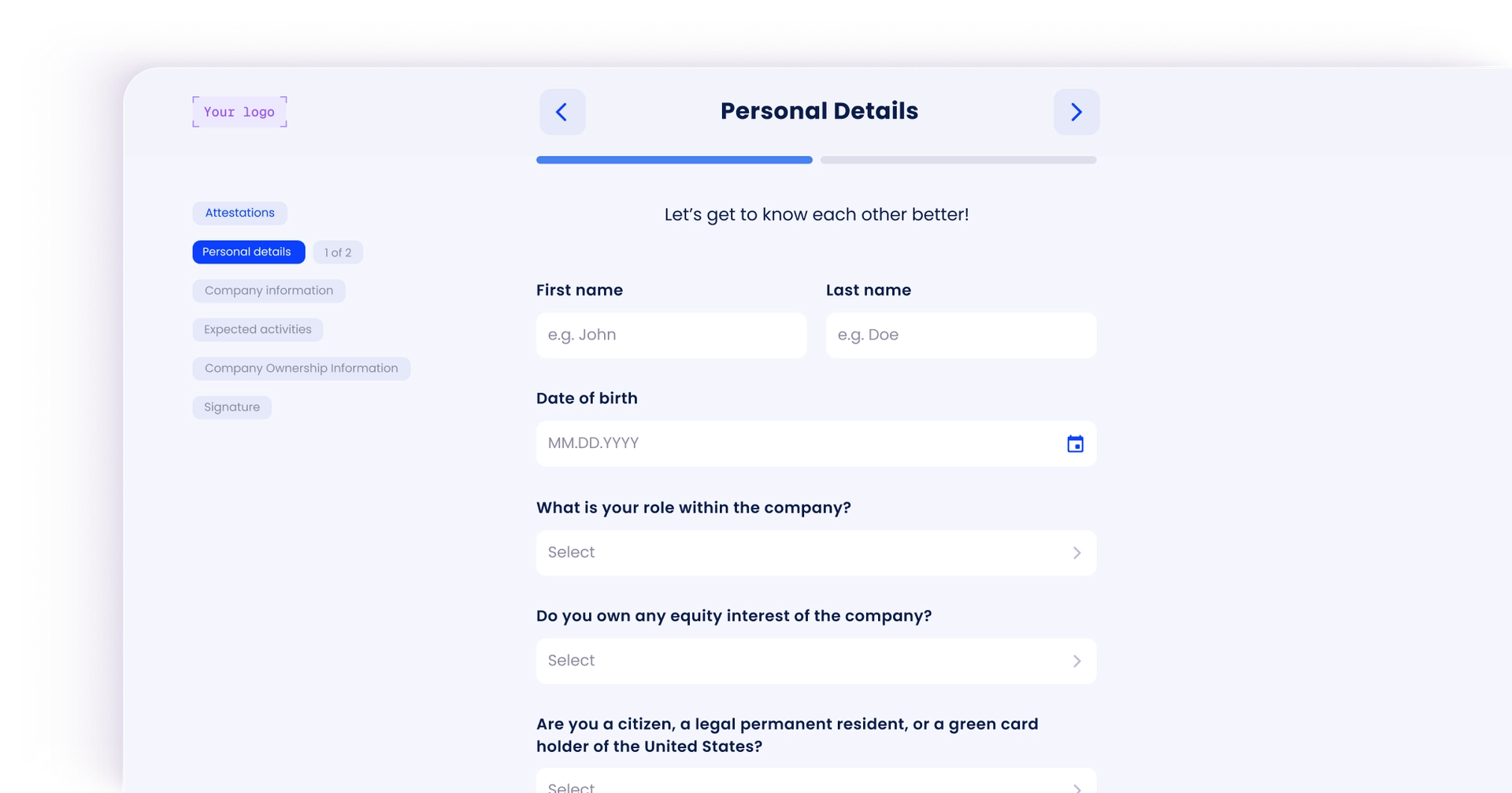

Launching a new financial product without infrastructure, struggling with time, team size, and compliance complexity.

What You Unlock

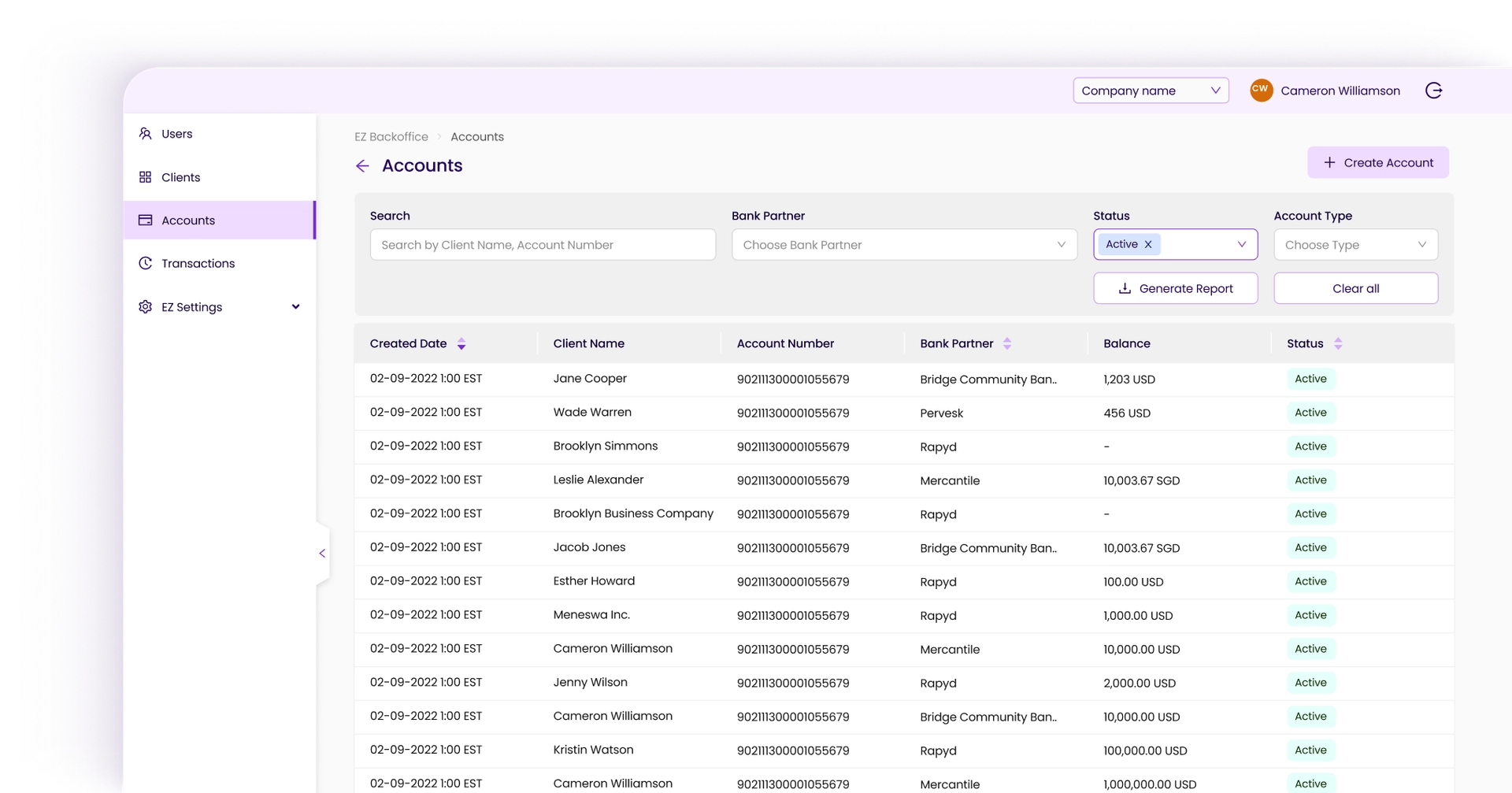

A ready-to-deploy stack including onboarding, compliance, payments, accounts, and UI. Focus on product and growth — go live in 3 months.

Embedded finance use cases

Starting Point

Embedding payments or banking into a non-financial product — blocked by regulation, integration overhead, or long go-live cycles.

What You Unlock

Easily plug in financial features like onboarding, compliance, and payments into your platform with secure, modular APIs.

Payment apps & wallets

Starting Point

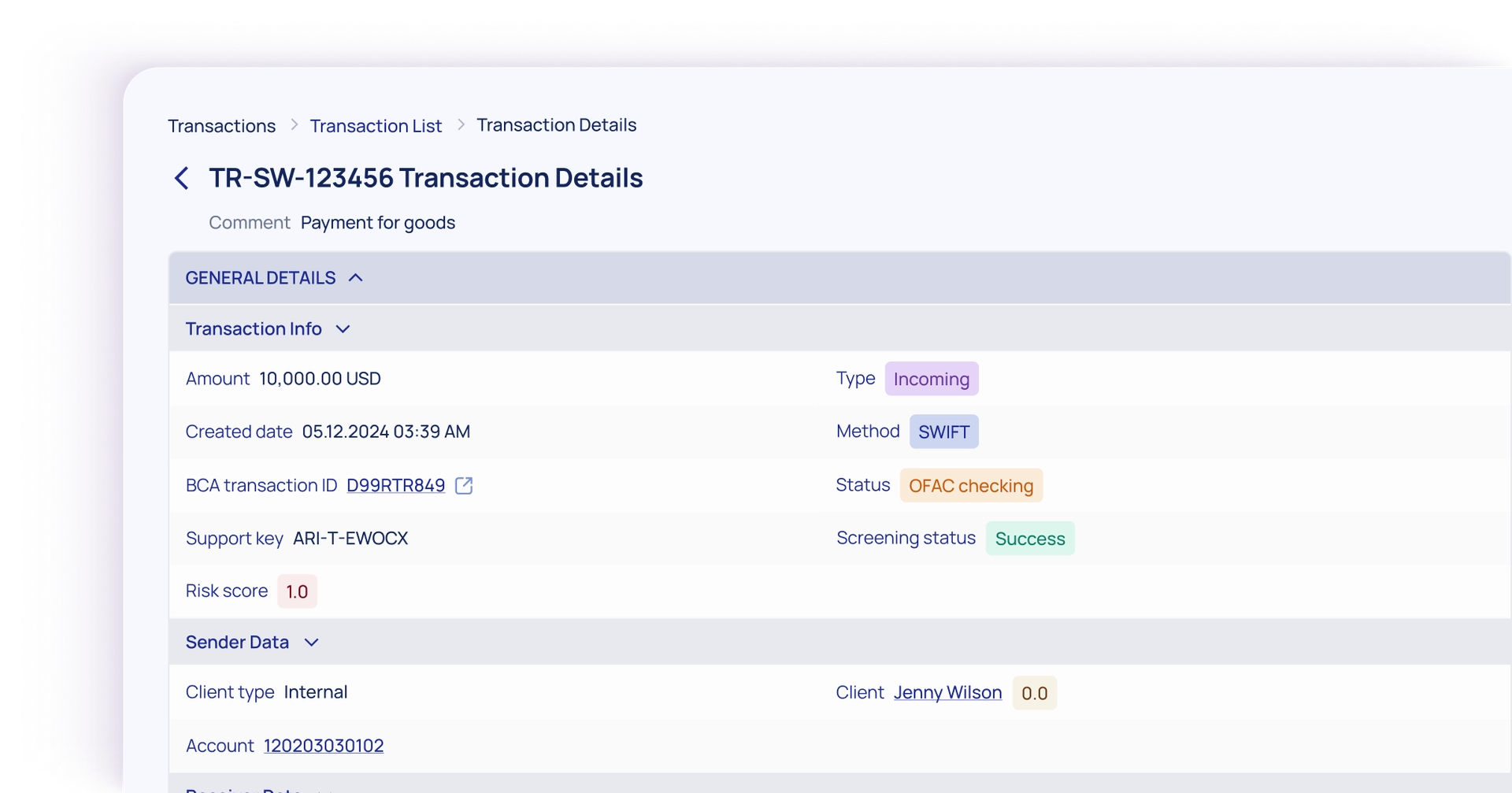

Building wallets or payment flows from scratch, dealing with risk logic, compliance, and transaction security.

What You Unlock

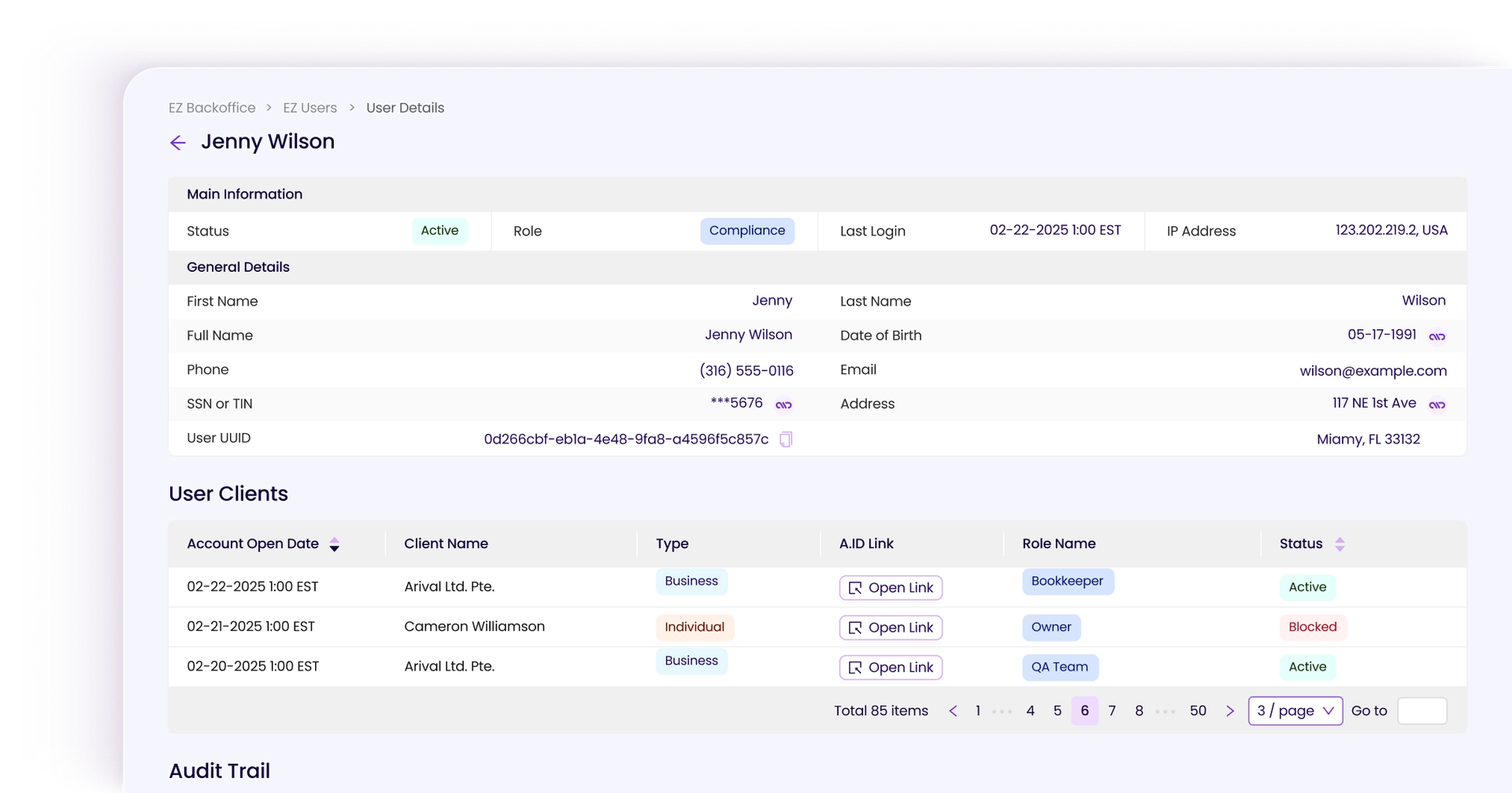

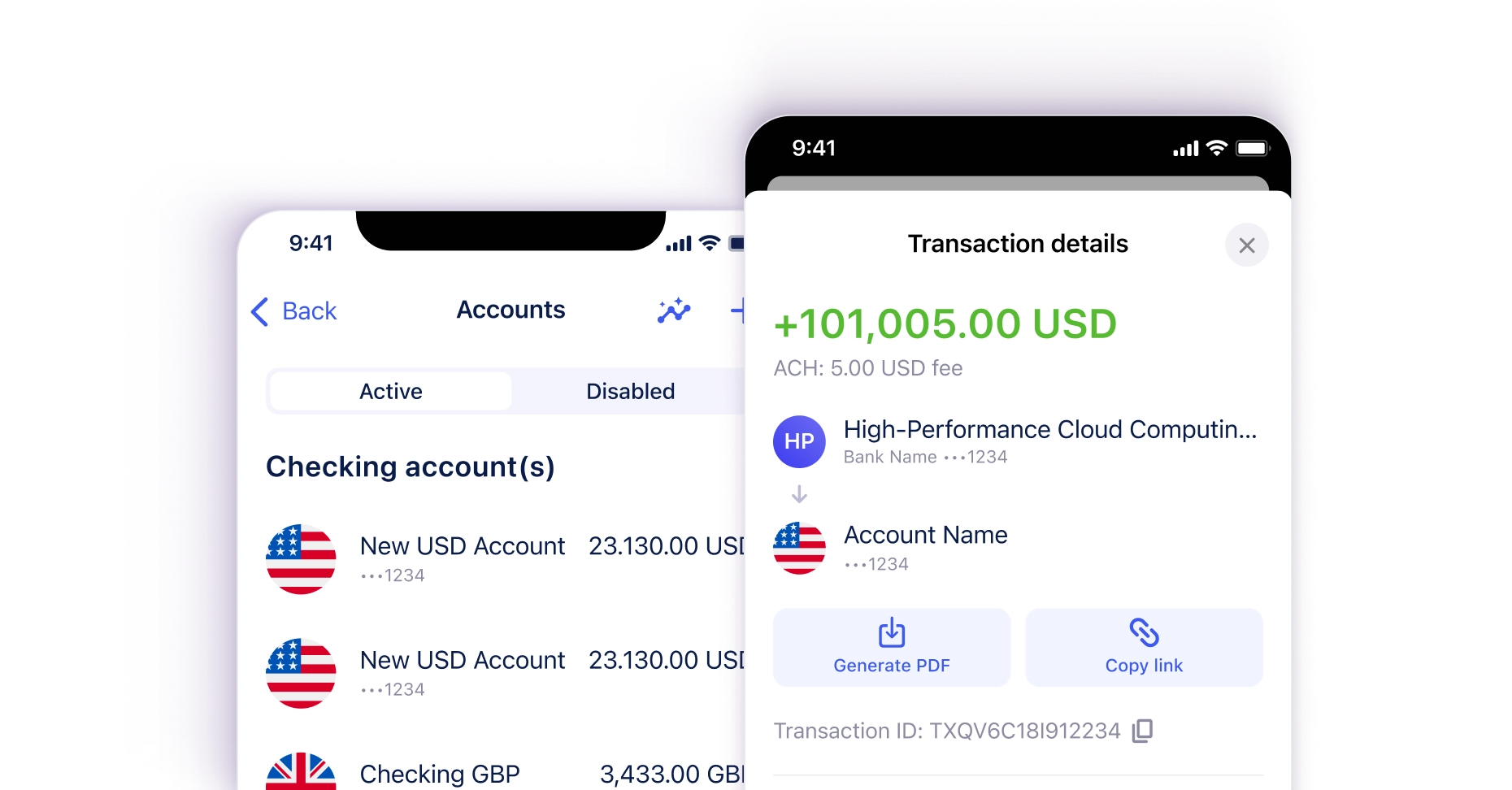

Pre-built modules for issuing accounts, managing balances, processing payments, and tracking risk — with full audit trail.

Crypto seeking compliance

Starting Point

Operating in high-risk environments without reliable KYC, monitoring, or tools to meet regulatory expectations.

What You Unlock

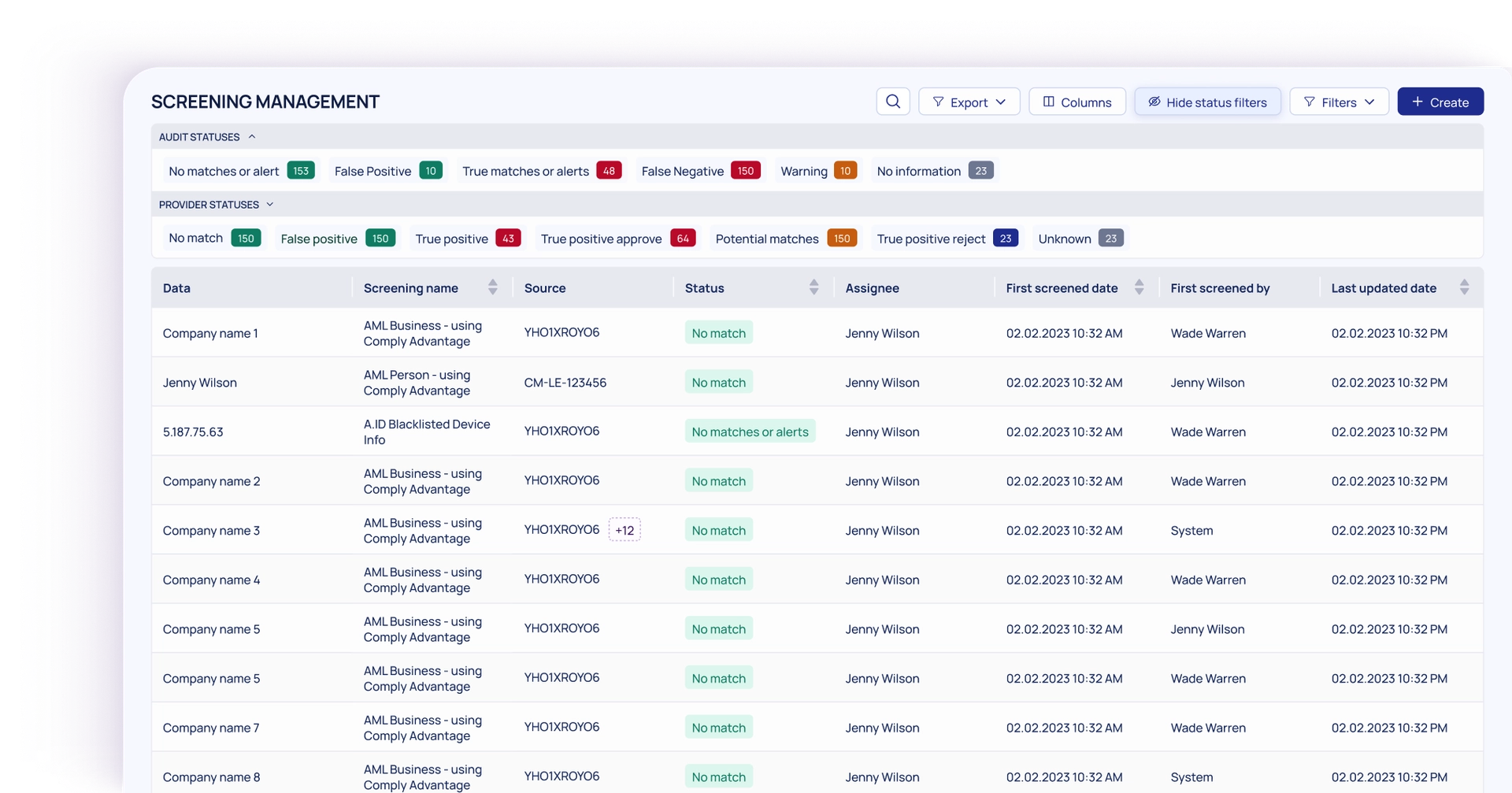

Add an enterprise-grade compliance layer with eKYC, sanctions screening, transaction monitoring, and audit readiness.

MVPs with a short runway

Starting Point

Limited budget and short timeline to validate a concept, attract funding, or start onboarding users.

What You Unlock

Build a working MVP with real infrastructure in under 3 months — with UX, compliance, and payments ready to go.

Built to perform

Everything under the hood — ready to go:

Timeline

Client journey

Idea!

You have a concept or need for a digital banking solution — we’re here to shape it.

Call

We jump on a quick intro call to understand goals, timeline, and fit.

Meet

A deeper strategy session to align vision, scope, and stakeholders.

Brief

You send us your needs — we return with a proposed solution architecture.

Sign

We finalize the scope, agree on deliverables, and sign the contract.

Intro

Our delivery and product teams onboard you into the process.

Demo

We show the first working version — design, flows, or infrastructure.

Fixes

You give feedback — we refine and improve based on real input.

Polish

Final polishing, edge-case review, and readiness checklist.

Ready!

Everything is in place. You`re live and supported by our team.

From idea to production — starting from 3 months*.

Launch a fully compliant, integrated fintech product — faster than you thought possible.

*Timelines depend on your scope, integrations, and regulatory requirements.

Contact us!

Contact SalesSkaya, Inc. (Skaya) is a technology and services company, not a bank. Banking services are provided by Skaya's bank partners. EZ, EZ Banking and EZ ID are registered trademarks of Skaya.