Launch smarter. Scale faster.

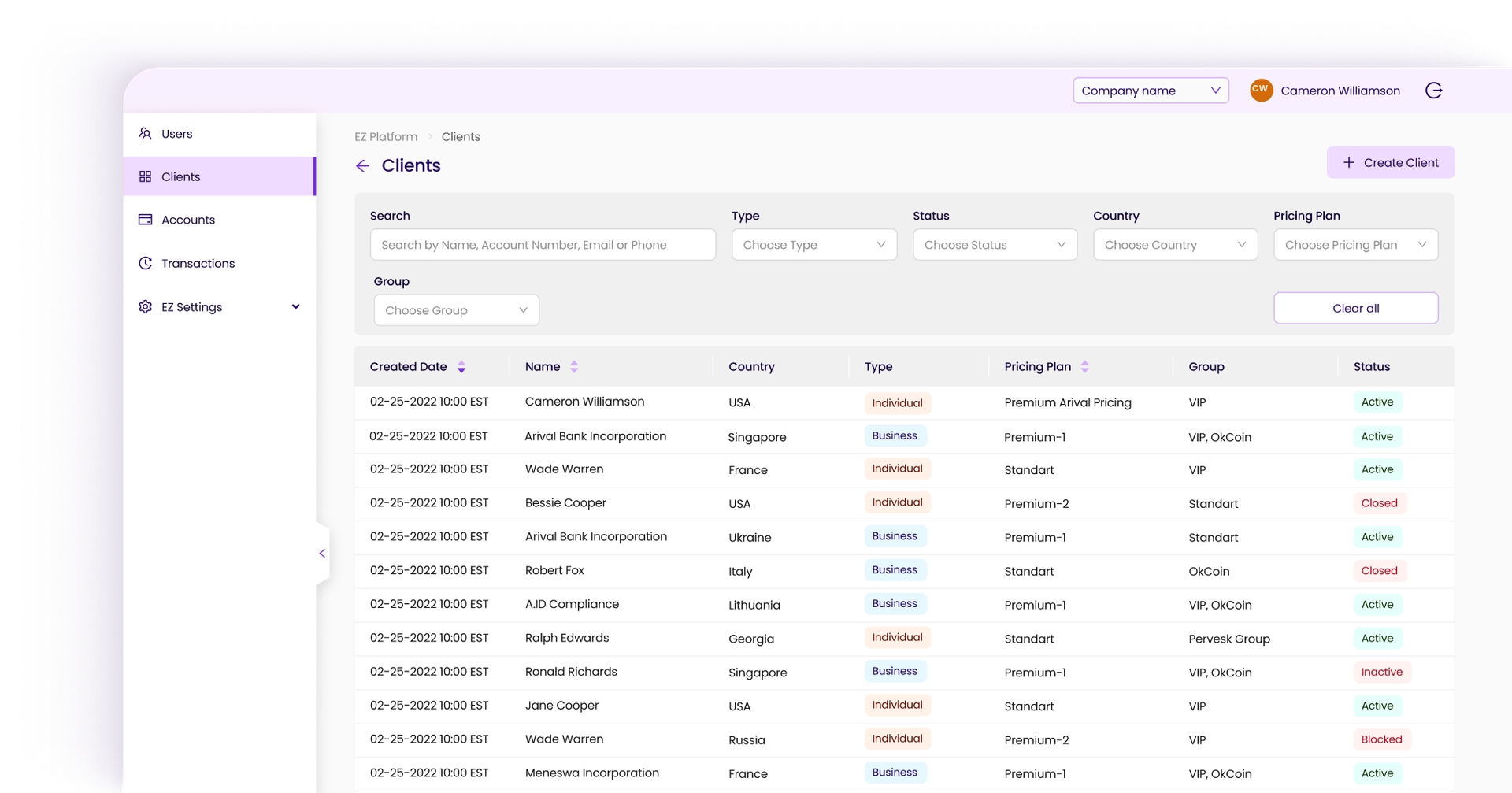

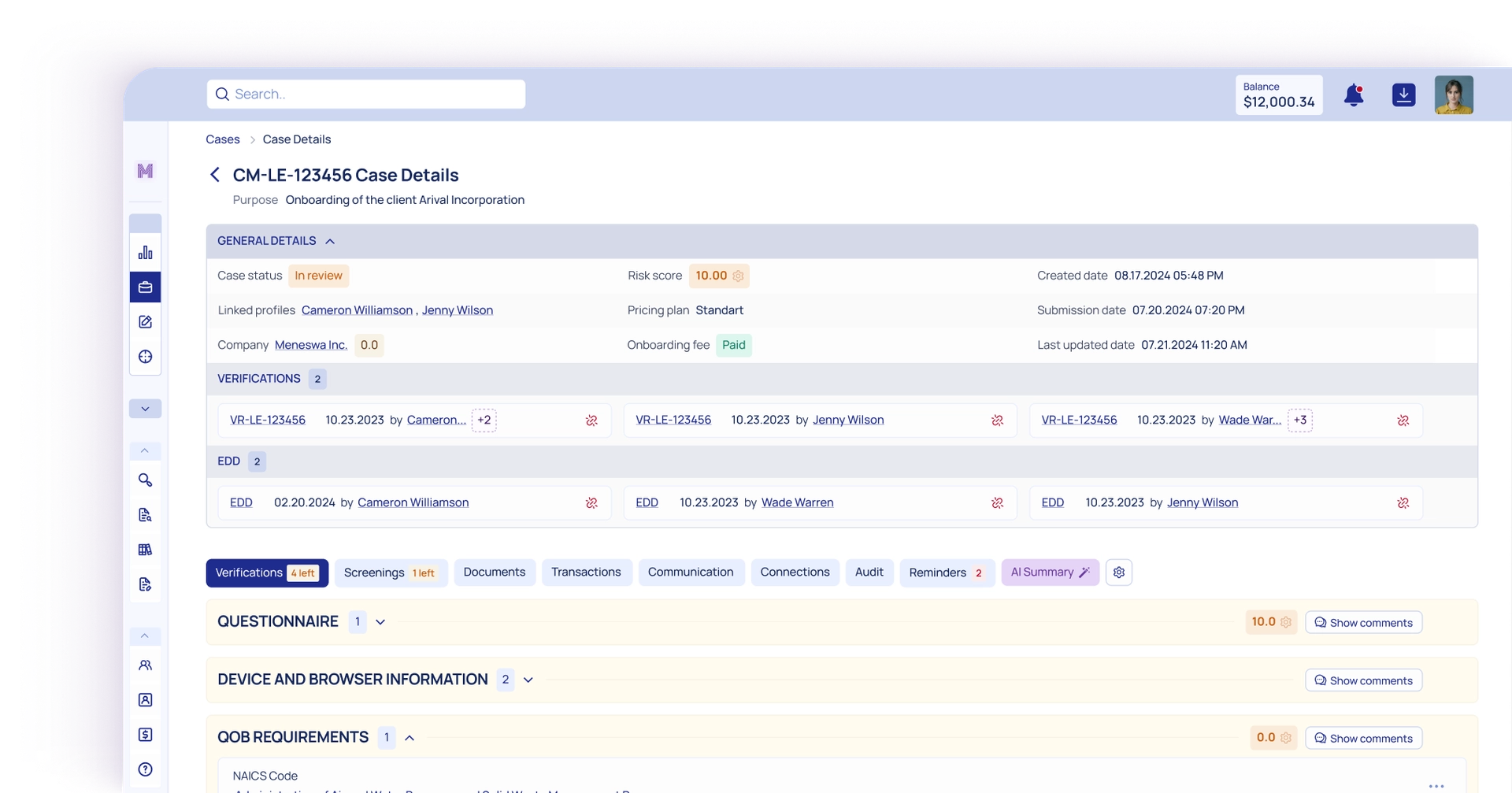

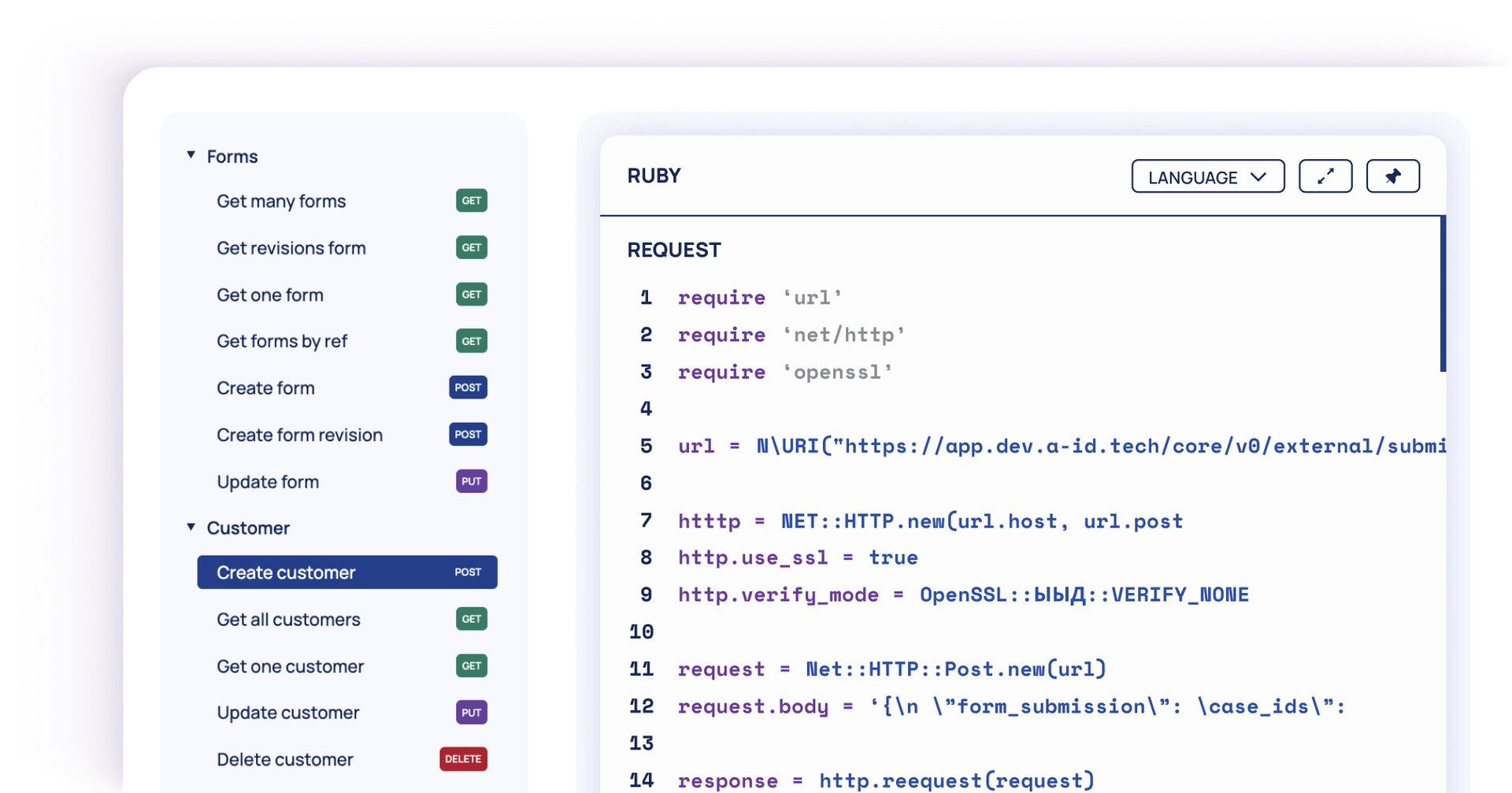

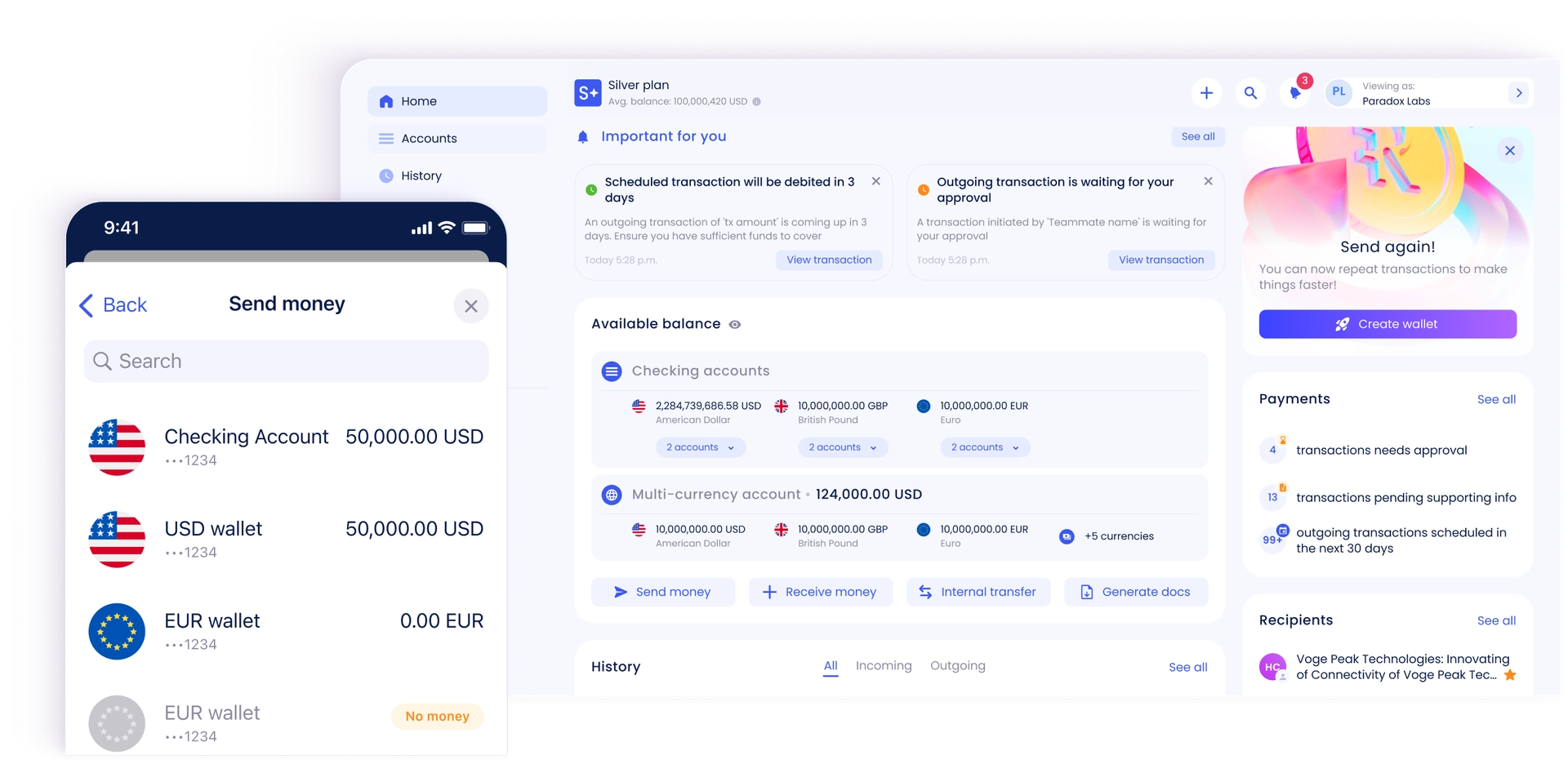

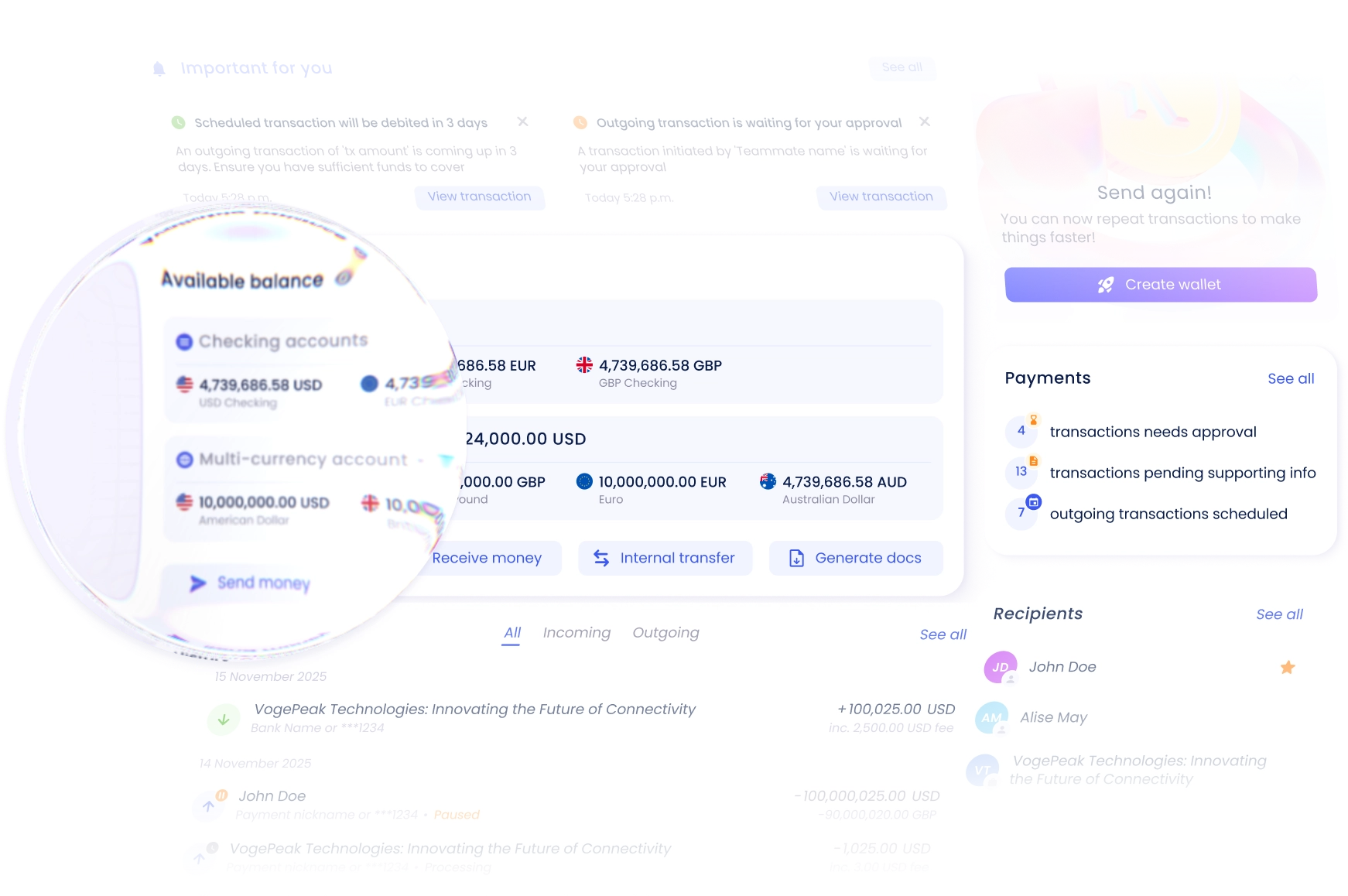

Pre-built banking apps, APIs, and compliance tools — plug into your existing architecture or launch as a standalone solution.

Problem / Promise

You don’t need to start from scratch.

We provide a complete banking front-end and operational backend — designed for rapid deployment and easy integration. Use what you need, connect where it matters.

What’s included

All the building blocks you need.

Who it’s for

Ideal for:

Legacy banks going digital

Starting Point

Launching digital products inside a traditional bank — slowed down by legacy systems, poor UX, and limited dev resources.

What You Unlock

Deploy white-label web & mobile apps, APIs, and compliance tools on top of your existing core — no full system overhaul needed.

Product teams building new verticals

Starting Point

Tasked with launching a new banking vertical under time pressure — often lacking infrastructure and internal KYC/compliance stack.

What You Unlock

Use modular components to assemble and launch new verticals faster — with pre-integrated onboarding, compliance, and UI.

Fintechs needing a rapid MVP

Starting Point

Validated the concept but no infrastructure to launch an MVP — no time to build everything from scratch.

What You Unlock

Get to market with a functional MVP in weeks — UI, accounts, and compliance tools all included.

Compliance-led modernization

Starting Point

Operating with manual compliance workflows and limited auditability — slowing down growth and increasing risk.

What You Unlock

Automate KYC/AML/EDD with A.ID modules, gain full audit trail, and stay regulator-ready as you grow.

Arival Integration

Go live faster with a licensed bank

Use Arival Bank — a regulated digital bank — as your backend for payments, account issuing, and compliance. No need to build or license everything yourself.

Timeline

Client journey

Idea!

You have a concept or need for a digital banking solution — we’re here to shape it.

Call

We jump on a quick intro call to understand goals, timeline, and fit.

Meet

A deeper strategy session to align vision, scope, and stakeholders.

Brief

You send us your needs — we return with a proposed solution architecture.

Sign

We finalize the scope, agree on deliverables, and sign the contract.

Intro

Our delivery and product teams onboard you into the process.

Demo

We show the first working version — design, flows, or infrastructure.

Fixes

You give feedback — we refine and improve based on real input.

Polish

Final polishing, edge-case review, and readiness checklist.

Ready!

Everything is in place. You`re live and supported by our team.

Get your bank moving — today.

Book a demo

Contact us!

Contact SalesSkaya, Inc. (Skaya) is a technology and services company, not a bank. Banking services are provided by Skaya's bank partners. EZ, EZ Banking and EZ ID are registered trademarks of Skaya.