Transform your legacy system. Elevate your bank.

Modern UI, compliance, and integrations — layered on top of your existing core system.

Pain → Solution

Legacy doesn’t have to mean obsolete.

You don’t need to replace your core to stay competitive. We help you upgrade what matters — customer experience, compliance, and speed — without disrupting operations.

What we deliver

Modular upgrades. Minimal disruption.

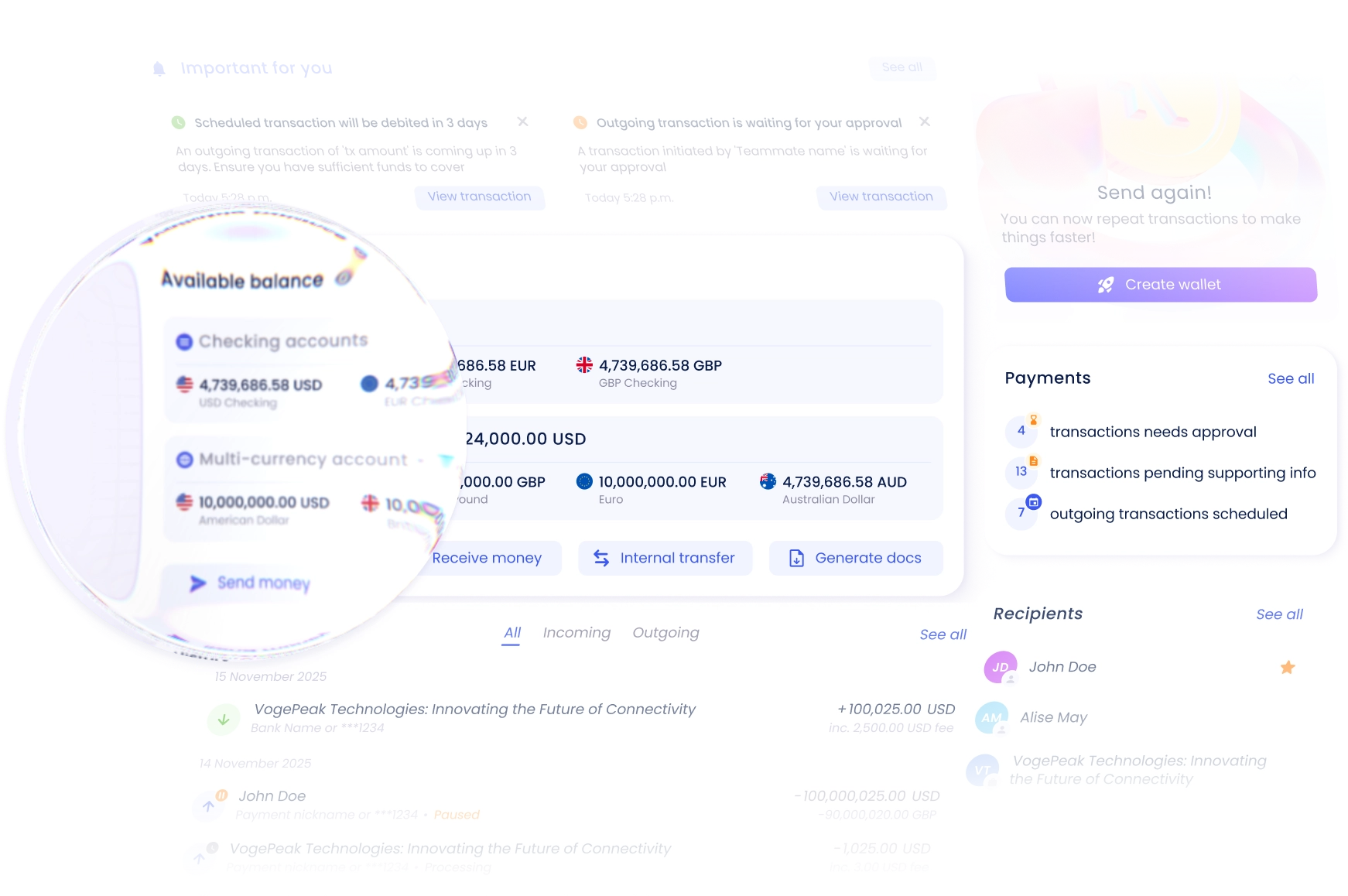

UI & UX Modernization

White-label web and mobile interfaces that instantly refresh your customer-facing experience.

Compliance Layer

Plug-and-play A.ID modules for KYC, KYB, AML, and ongoing monitoring in regulated environments.

API Connectivity

Designed to link modern frontend and compliance tools to your legacy backend via a stable integration layer.

Global-readiness

Multi-jurisdictional setup, risk controls, and localization tools for international deployment.

Licensed banking option

Integrate with Arival Bank infrastructure if you need instant access to banking rails.

Who it’s for

Made for:

Legacy banks modernizing

Starting Point

Legacy core systems limit your ability to innovate and deliver modern user experiences. Full core replacement is too risky or expensive.

What You Unlock

Launch new UX, APIs, and compliance modules on top of your core. Modernize without disruption.

Compliance upgrades

Starting Point

Manual compliance workflows slow you down and create risk. Teams rely on spreadsheets and disconnected tools.

What You Unlock

Automate onboarding, screening, and audit trails in one platform. Meet global regulatory standards with ease.

Global expansion teams

Starting Point

Entering new markets is hard with different compliance rules and localization demands. Your current system wasn’t built for that.

What You Unlock

Quickly launch digital products with local UX and pre-built compliance layers. Expand globally without rebuilding.

Risk-averse migration

Starting Point

Replacing the core feels too risky, so innovation is frozen and tech debt keeps growing. Teams hesitate to touch what`s already working.

What You Unlock

Modernize safely by layering new UI, APIs, and compliance tools on top of your core. No downtime, no disruption — just visible progress.

Real case: Arival

Validated in production.

Arival Bank, a fully licensed digital institution, runs on this exact architecture. With A.ID powering compliance and our modular stack delivering speed and control, Arival scaled globally — without rebuilding from zero. Now you can too.

Timeline

Client journey

Idea!

You have a concept or need for a digital banking solution — we’re here to shape it.

Call

We jump on a quick intro call to understand goals, timeline, and fit.

Meet

A deeper strategy session to align vision, scope, and stakeholders.

Brief

You send us your needs — we return with a proposed solution architecture.

Sign

We finalize the scope, agree on deliverables, and sign the contract.

Intro

Our delivery and product teams onboard you into the process.

Demo

We show the first working version — design, flows, or infrastructure.

Fixes

You give feedback — we refine and improve based on real input.

Polish

Final polishing, edge-case review, and readiness checklist.

Ready!

Everything is in place. You`re live and supported by our team.

Why it works

No disruption. Real transformation.

We don’t replace what already works. Instead, we build on top of it: a stable, modern, compliant layer that gives you visible value from day one.

Upgrade without downtime

Avoid migration costs

Keep control of existing infrastructure

Add new features at your pace

Ready to future-proof your core?

Book a demo

Contact us!

Contact SalesSkaya, Inc. (Skaya) is a technology and services company, not a bank. Banking services are provided by Skaya's bank partners. EZ, EZ Banking and EZ ID are registered trademarks of Skaya.